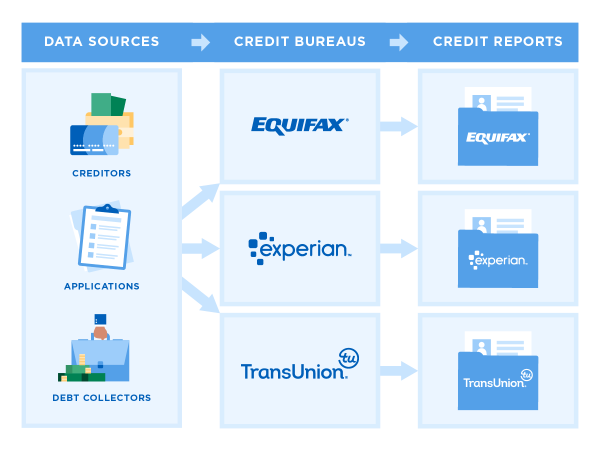

Credit Bureaus, Credit Files, Credit Reports, and Credit Scores 2.1 Credit Bureaus The consumer reporting system enables creditors and other providers of consumer services to pool information about their respective customers and use that pooled information to inform their credit and other risk decisions about new applicants and existing customers.

Credit bureaus first emerged in the United States in the late 1800s to support merchant lenders who extended credit to local businesses and individuals.11 At that time, the “credit bureau” consisted of a list of individuals who had not repaid their debts as agreed and were therefore deemed poor credit risks. Prior to the use of such lists, local merchants extended only very small amounts of credit,

and these credit decisions depended largely on the merchant’s direct personal knowledge of the individual borrower’s personal character. The credit reporting industry grew steadily with growing interest on the part of both consumers and merchants in using credit in purchase transactions. In the 1920s and again in the 1950s,

credit bureaus experienced particularly rapid growth with the introduction of retail installment credit and revolving credit accounts,12 in the 1970s and 1980s with the growth of bank credit cards,

and in the 1990s with the automation of mortgage underwriting. By the early 1970s, the industry comprised over 2,250 firms, most with local or regional coverage. As the 1970s progressed, the industry began to consolidate.13 With the development of computer databases, nationwide credit card issuers, and automated underwriting, the threshold of technological investment required to distribute credit reports increased, as did the importance of offering nationwide coverage.

Many of the local bureaus sold their records to the major national bureaus. Today, the consumer reporting landscape includes large national bureaus like the NCRAs; bureaus with credit information such as payday loans, utility and telephone accounts, and other credit relationships; a number of specialized consumer reporting agencies with medical information, employment history, residential history, check writing history, checking account history, insurance claims, and other non-credit relationships; as a well as a few hundred resellers of credit reports. By 2011,

the NCRAs generated U.S. revenues of about $4 billion,14 including revenues from several ancillary businesses such as the sale of lists and non-credit consumer information for marketing purposes, the sale of credit monitoring services directly to consumers or through resellers, and analytical services that provide credit scores and other modeling tools to creditors.